FAQ: Investing

Why should I invest?

Our projects provide a triple-bottom line approach to renewable energy:

People: We put community first. We’re a member-owned co-op, and our projects are financed by community members, for the community.

Planet: Our renewable energy projects lower the carbon footprint of Oregon communities. And by offering an alternative investment to fossil fuels, they help shift our society towards a green economy.

Profits: Our members make money from their investments in our projects. And the schools, nonprofits, churches and other community organizations we work with lower their energy bills from our solar projects.

What’s the risk?

Any investment carries some degree of risk, and we try to spell out the risks of investing in our projects in each project’s Offering Memorandum, which you should review carefully before investing, and which includes this statement:

The shares offered involve a high degree of risk. In making an investment decision, prospective investors must rely on their own investigation of OCPC and they should study this entire Offering Memorandum carefully. Prospective investors should not rely on any information provided directly by OCPC other than that provided in this Offering Memorandum, including without limitation any information on the OCPC Website or in investor meetings, in making an investment decision. The information in this Memorandum does not constitute legal, financial, or tax advice, and prospective investors should consult their own advisors.

How does the risk compare to other investments?

Investments in our projects are not insured, as a saving account might be, and we cannot guarantee that you will get your investment back. The risk may be reduced because we aim to pay back a portion of your investment, along with a dividend, each year, although we cannot guarantee that.

What’s the return?

You choose what rate you want to receive. We’ve been paying between 1% and 4% APR, typically for ten or twelve years, although aome of our projects now have shorter investment periods. A two or three year investment period allows us to build the project while we’re waiting for tax credits or grants to come in. The rate stays the same for the term of your investment. For our longer investments, we expect, but don’t guarantee, to pay you back some of your initial investment and a dividend each year.

How much will I get back each year?

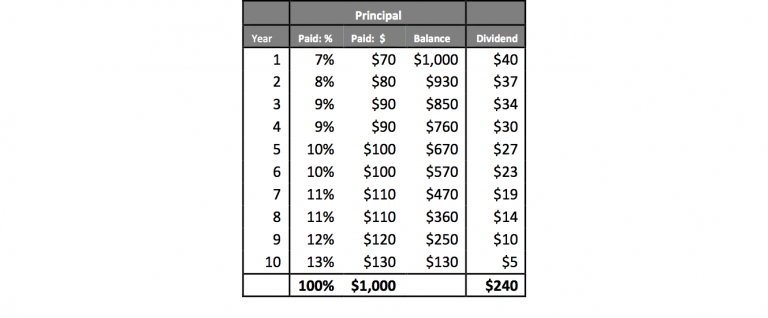

That depends on the project. For two or three year investments, we expect to pay you interest annually until the end of the investment term, at which point we’ll repay your principal. For longer term investments we expect, but don’t guarantee, to pay back between 5% and 8% the first year, and gradually increase that percentage over the term of the investment.

For example, for some recent projects, for each $1,000 invested, we sent out checks after the first year for 8% of the investment, plus a 4% dividend. So $80 + $40 = $120. The second year, we’ll pay a dividend of 4% on $920, plus more of your investment. The percentage of the investment paid back each year may vary, but by the end of ten years, you would receive your full $1,000 back, plus a dividend on your remaining balance each year.

Here is a sample schedule of projected payments for a ten-year investment:

Is community investment enough to fund an entire project?

Usually not, so we combine the community investment with grants, Energy Trust of Oregon solar incentives, tax credits and other financing sources.

Do I have to be a member of Solar Oregon before I invest?

No. We are partnered with Solar Oregon, a nonprofit which supports solar throughout Oregon. Unless you’re already a Solar Oregon member, we will sign you up as part of the investment process.

What do I do if I have more questions?

Please contact us at info@oregoncleanpower.coop.